Know your industry, improve your business

The most appreciated national research for the foodservice industry in Romania 3 segments: traditional, delivery and retail!

7 consecutive editions, 2023

Co-funders of previous editions

Find the research results

-

Reports

Timp de bucurie alături de copii – Comportament de achiziție și consum in Horeca

1.500,00 leiAdd to cartRaport segment: Timp de bucurie alături de copii

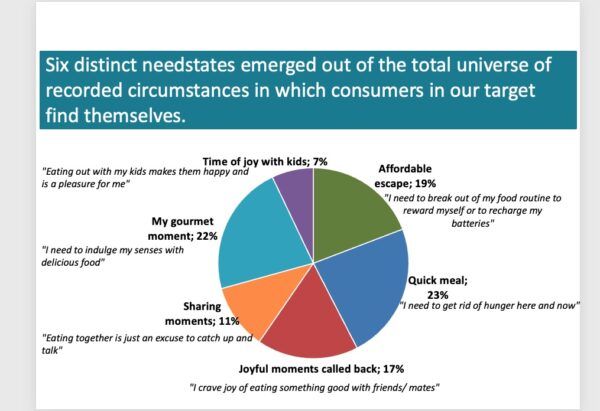

Nevoia profundă care declanșează această ocazie de consum pare să fie consolidarea sentimentului de a fi un părinte bun. De aceea, adulții implicați în astfel de momente caută să creeze clipe de fericire pentru copiii lor, dar într-un mod accesibil din punct de vedere financiar (veniturile persoanelor care participă la aceste ocazii sunt cele mai mici). Preferințele copiilor contează foarte mult în alegerea locației. Aproape fiecare aspect al ofertei locației – mâncare, spațiu, servicii – trebuie să răspundă nevoilor copiilor pentru a deveni eligibilă în astfel de circumstanțe.

-

Reports

Momentele de împărtășire – Comportament de achiziție și consum in Horeca

1.500,00 leiAdd to cartRaport segment: Momentele de împărtășire.

Nevoia profundă este de a consolida sau îmbunătăți relațiile cu membrii familiei sau prietenii. Este mai mult despre conectarea cu cei dragi și mai puțin despre satisfacerea foamei. Luarea mesei în afara casei, în special în restaurante standard, pare a fi o scuză pentru a petrece timp de calitate alături de cei apropiați. Acesta este motivul pentru care ambianța (în special comportamentul personalului) rămâne un criteriu important în alegerea locației și/sau evaluarea experienței.

-

Reports

Masa rapida – Comportament de achiziție și consum in Horeca

1.500,00 leiAdd to cartRaport segment: Masa rapida

Masa rapidă este o ocazie funcțională în care obiectivul principal este eliminarea foamei. Persoanele implicate în astfel de momente nu au timp să gătească, să pregătească mâncarea sau să aștepte, deoarece trebuie să-și potolească foamea „aici și acum”. Nu au mult timp de petrecut în locație – 8 din 10 persoane stau mai puțin de o oră, iar aproape jumătate mai puțin de 30 de minute, fie singure, fie în compania colegilor.

-

Reports

Momentul meu gourmet – Comportament de achiziție și consum in Horeca

1.500,00 leiAdd to cartRaport segment: Momentul meu gourmet

Acestea sunt situații care apar atunci când persoanele sunt relaxate și au dispoziția de a fi răsfățate. Nu este vorba doar despre satisfacerea foamei, ci mai degrabă despre modul în care această foame va fi potolită, deoarece răsfățul simțurilor determină alegerile în astfel de momente. Mâncărurile din meniu reprezintă un criteriu foarte important în alegerea locației, fie că optează să ia masa acolo, fie că apelează la serviciul de livrare.

What

do we

do?

We implement the largest research dedicated to the hospitality industry in Romania! We analyze both the sitting or restaurant market and the food delivery market.

The data are collected through quantitative research techniques in major urban centers: Bucharest, Cluj, Timisoara, Brasov, Iasi.

Your business will be able to develop in a healthy way, in line with today’s reality and future trends.

It will benefit from a professional analysis on the real sizing of the food industry in Romania, customer consumption behavior, market trends and needs.

Sociological research results are confidential!

Why food research?

The food industry in Romania is growing faster and faster.

New concepts and new locations, new investors with new mentalities are emerging.

But statistics tell us that 6 out of 10 restaurants, bars and cafes go out of business in the first nine months of operation.

The locations end up hosting new concepts based on new mindsets.

The lack of research on the customer and the market in this field means that,

erroneously, the market develops according to the wishes of entrepreneurs and not according to the real needs and expectations of customers.

Who

is this for?

Entrepreneurs and managers in the hospitality industry.

Suppliers of services and products for the hospitality industry.

Public authorities.

Investment funds, business angels.

CO-FUND the research NOW and be one of the players with access

to the most detailed data on the needs and behavior of customers or potential customers.

What will you learn?

Excerpt from the questionnaire and research methodology, valid for the 7th edition, 2023

Delivery

- Usage of delivery services

- Trend – Usage of delivery services

- Churn – delivery

- Delivery locations

- Methods of ordering food home/work

- Mobile app of ordering food home/work

- General Interaction with the deliverer – importance

Buying habits

- Types of locations, general

- Trend, types of location

- Types of location, by region

- Acquisition frequency

- Number of visits per location type

- Trend, number of visits per location type

- Consumption occasions, general by type of location

- The most important occasion for eating outside the house

- Locations cuisine, general, by type of location

- Trend, locations kitchen

- Locations cuisine, by region

Last experience

- Types of locations

- Time of the day and moment of the consumption

- Consumption occasions

- Socialization, with whom?

- Awareness, sources of information

- Decision criteria

- Criteria about menu in choosing the location

- General/specific satisfaction

- Bought products categories

- Acquisition value

- Market value

- Recommendation

Inflation panel information

How

do we do it?

Methodology

CATI – Computer-Assisted Telephone Interviewing

Telephone interviews with 800 respondents nationwide, targeting urban areas: Bucharest, Brasov, Timisoara, Cluj, Iasi.

Respondents are segmented by:

Age (under 25, 25-35, 35-50, 50-60, over 60)

income (under 1000 lei/household member, between 1000-1500 lei/household member, between 1500-2500 lei/household member, between 2500-3000 lei/household member, over 3000 lei/household member).

About Hospitality Culture Institute

Hospitality Culture is the first independent research, training and consultancy institute in Romania that studies the market and trends in the HoReCa industry.

Its mission is to identify trends with social, economic and political impact and to share know-how and concrete solutions.

It organizes 2 annual editions of the Food&Beverages INNOVATION Camp together with industry leaders and teams of start-up founders and local producers.

Supports the entrepreneurial environment through the F&B Business Accelerator by providing training and mentoring using over 70 experts to teams of founders in the industry.